Become an O8 Affiliate – Earn 20% commission on all sales.

Become an O8 Affiliate – Earn 20% commission on all sales.

Small Business Cash Flow Problems: Why Profitable Businesses Go Broke

Profit on paper. Broke in reality. That's a timing problem, not a mystery.

You made $80,000 last month. Your P&L says you're profitable. Your accountant isn't worried.

But you can't make payroll.

Your bank account says $3,200. Rent is due. Vendor invoices are stacking up. And you're wondering how a profitable business can be this broke.

Welcome to the cash flow gap. The constraint that kills more small businesses than bad products, bad marketing, or bad luck combined.

Here's what's actually happening: Money is coming in slower than it's going out. That's it. Not complicated. Not a mystery. A timing problem.

And like all constraints, you can't fix it by working harder or hoping it resolves itself. You fix it by identifying where the timing breaks, exploiting what capacity you have, and elevating the constraint permanently.

This is cash flow through The O8 framework. Operations + Operating System. Fix both or fix neither.

The Profit vs. Cash Flow Gap (And Why Your Accountant Isn't Warning You)

Your P&L and your bank account are telling two different stories. Both are true.

Your P&L says: You invoiced $80,000 last month. Expenses were $55,000. You made $25,000 profit.

Your bank account says: You collected $42,000. You spent $61,000. You're down $19,000.

The gap? Timing.

Your P&L uses accrual accounting. It counts money when you invoice it, not when you collect it. It counts expenses when you incur them, not when you pay them.

Accrual accounting is great for taxes. It's terrible for operations.

Here's what your P&L won't tell you:

That $80,000 invoice? Client has net-60 terms. You won't see it for two months.

That $15,000 in expenses? You pre-paid for inventory that won't sell for three weeks.

That profitable month? It drained your bank account by $19,000.

This is how profitable businesses go broke. They're managing to the wrong scoreboard.

The math:

82% of small business failures cite cash flow problems as a contributing factor

60% of small business owners don't feel confident managing their cash flow

The average small business has 27 days of cash runway

You're not failing. You're flying blind.

The 5 Cash Flow Killers in Small Business

Cash flow problems aren't random. They follow patterns. Here are the five constraints that create the timing gap:

1. Customer Payment Terms (The Receivables Constraint)

You invoice on delivery. Client pays in 45 days. You have expenses now.

The math:

$100,000 in monthly revenue

45-day average collection period

You're carrying $150,000 in receivables at any given time

That's $150,000 that should be in your bank account but isn't

The constraint: The time between when you deliver value and when you collect payment.

Common triggers:

Net-30, net-60, net-90 payment terms

Clients who pay "whenever" and you don't chase

Payment terms you agreed to without modeling the impact

Large projects with milestone payments (you're fronting costs for months)

2. Inventory Timing Mismatches (The Capital Lock-Up Constraint)

You buy inventory before you sell it. You pay suppliers before customers pay you.

The math:

You purchase $30,000 in inventory

Average time to sale: 45 days

You've locked up $30,000 in cash for 6 weeks

If supplier terms are net-15 and customer terms are net-30, you're paying out 15 days before you collect

The constraint: The gap between when you pay for goods and when you convert them to cash.

Common triggers:

Buying inventory in bulk to get discounts (saving 10%, losing liquidity)

Seasonal businesses that stock up months ahead

Custom orders where you purchase materials before client payment

"Just in case" inventory that sits

3. Overhead Creep During Growth (The Fixed Cost Constraint)

Revenue grows. You hire more people, lease more space, add more tools. Fixed costs jump before variable revenue stabilizes.

The math:

You add $8,000/month in payroll to handle growth

New revenue takes 60 days to stabilize

You've just increased monthly burn by $8,000 with no immediate offset

If you miscalculated demand, you're bleeding $8,000/month until you adjust

The constraint: Fixed costs are immediate. Revenue growth is delayed.

Common triggers:

Hiring ahead of revenue (betting on growth that's slower than expected)

Upgrading office space "because we need room to grow"

Adding software subscriptions "to scale operations"

Creating roles before confirming demand for them

4. Tax Timing Surprises (The Deferred Liability Constraint)

You made profit in Q1. You spent it in Q2. Tax bill hits in Q3. You don't have it.

The math:

Q1 profit: $60,000

Tax liability (assuming 30%): $18,000

You didn't set it aside

June comes. You owe $18,000. You have $4,000.

The constraint: Profit creates a future liability you forgot to account for.

Common triggers:

Quarterly estimated taxes for profitable periods

End-of-year tax bills that catch you off guard

Forgetting to set aside payroll taxes (very expensive mistake)

Sales tax collection that gets spent before remittance

5. Owner Draw Inconsistency (The Personal Constraint)

You take money out when it's available. You forget that "available" isn't the same as "yours."

The math:

Cash balance: $40,000

Upcoming expenses: $32,000 (you don't know this)

Owner draw: $15,000 "because we had a good month"

Remaining: $25,000

You're now $7,000 short

The constraint: Taking cash before understanding what's already committed.

Common triggers:

Drawing based on account balance, not forecasted availability

Irregular draws based on "how things feel"

Not separating owner compensation from business cash

Treating business profit as immediately available personal income

How to Read What's Actually Happening

Your P&L tells you if you're profitable. Your cash flow statement tells you if you'll survive.

Most small business owners don't look at cash flow statements. Big mistake.

Here's what you actually need to monitor:

1. Cash Flow Statement (Not P&L)

Your cash flow statement has three sections:

Operating Activities: Cash from running the business (collections - payments)

Investing Activities: Cash spent on assets (equipment, property)

Financing Activities: Cash from loans or owner contributions

You want operating cash flow to be positive. If it's consistently negative, you're not profitable—you're consuming cash faster than you generate it.

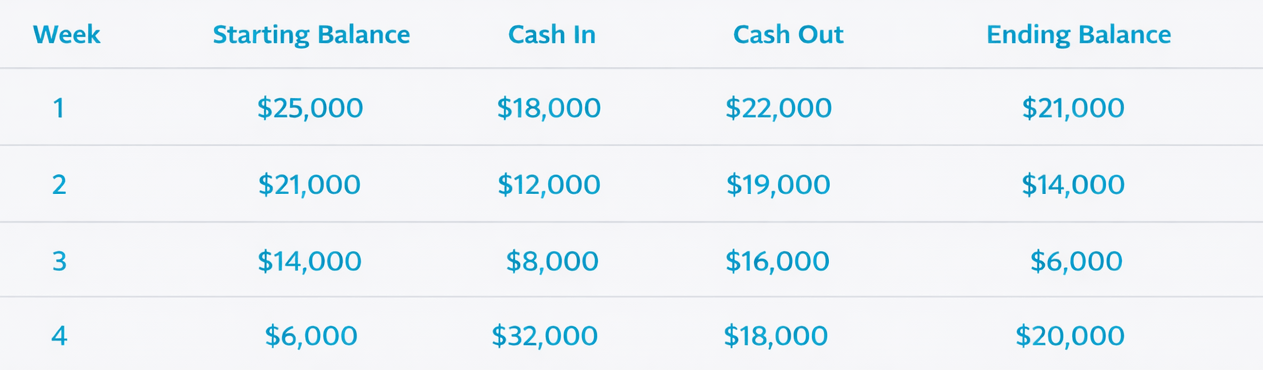

2. The 13-Week Cash Flow Forecast

This is the single most important tool for managing cash.

Why 13 weeks?

Long enough to see patterns

Short enough to be accurate

Aligns with quarterly planning cycles

What it shows:

Week-by-week projected cash in (based on invoices and collection patterns)

Week-by-week projected cash out (based on committed expenses)

Running cash balance

Projected low point (your "oh shit" moment)

How to build it:

Week 3 is your constraint. You drop to $6,000. If something unexpected hits, you're in crisis.

Now you know. You can move a payment. Accelerate a collection. Delay a purchase.

You can't fix what you can't see.

3. Leading Indicators (What to Watch Before Crisis Hits)

Don't wait for your bank balance to scream at you. Watch these:

Days Sales Outstanding (DSO): How long it takes to collect payment after invoicing

Formula: (Accounts Receivable / Total Credit Sales) × Number of Days

Target: Under 45 days for most businesses

Rising DSO = cash flow crisis incoming

Cash Conversion Cycle: How long cash is tied up in operations

Formula: Days Inventory Outstanding + Days Sales Outstanding - Days Payables Outstanding

The shorter, the better

Negative = You collect before you pay (ideal)

Burn Rate: How fast you consume cash

Formula: (Starting Cash - Ending Cash) / Number of Months

Know your burn rate. Know your runway.

If burn rate > revenue growth rate, fix it now.

Cash Runway: How long you can operate at current burn rate

Formula: Current Cash / Monthly Burn Rate

Target: Minimum 3 months, preferably 6

Under 3 months = red alert

How to Fix Cash Flow Problems

(The O8 Constraint Method)

Cash flow is a constraint. You fix it the same way you fix any constraint: Identify. Exploit. Subordinate. Elevate.

Step 1: Identify Your Cash Flow Constraint

Which of the five killers is draining you?

The diagnostic:

Run a 13-week cash flow forecast

Identify when you hit your low point

Trace back to the cause

Is it:

Receivables taking too long to collect?

Inventory sitting too long before sale?

Fixed costs that jumped before revenue stabilized?

Tax timing you didn't plan for?

Owner draws based on feelings, not forecasts?

You can't fix all five at once. Find the constraint—the one that's bleeding you the most.

Step 2: Exploit the Constraint

Before you fix it permanently, maximize what you have.

If the constraint is receivables:

Call every overdue invoice this week

Offer early payment discounts (2% off for payment in 10 days)

Move largest outstanding invoices to the top of the collection list

Batch all collection calls to one afternoon per week

If the constraint is inventory:

Run a flash sale on slow-moving stock

Delay next inventory purchase by 2 weeks

Negotiate extended terms with your supplier (you pay in 30, not 15)

Stop buying "just in case" inventory

If the constraint is overhead:

Freeze all non-critical hires

Renegotiate contracts (software, space, services)

Cut any subscriptions you're not actively using

Defer discretionary spending for 60 days

If the constraint is tax timing:

Set up a separate tax savings account today

Transfer 30% of every deposit into it (automate this)

Don't touch it until tax time

If the constraint is owner draws:

Set a fixed monthly draw based on your forecast, not your feelings

Take draws twice a month at fixed intervals

Stop looking at account balance as "available to me"

Exploitation buys you time. Use it to elevate the constraint.

Step 3: Subordinate Everything Else

Don't optimize what isn't the constraint.

If receivables are killing you, don't spend time optimizing your inventory management. Don't reorganize your team. Don't launch a new marketing campaign.

Focus all energy on fixing the cash flow constraint. Everything else can wait.

Subordination means: Every other part of your business supports fixing the bottleneck.

Sales team focuses on collecting overdue invoices, not just new deals

Operations delays non-urgent purchases until after you stabilize cash

Marketing waits on new campaigns until you have runway

Step 4: Elevate the Constraint (Fix It Permanently)

Now you fix it so it doesn't break again.

If the constraint is receivables:

Change payment terms (net-15 instead of net-45)

Require deposits on large projects (50% upfront, 50% on delivery)

Automate invoice reminders (3 days before due, day of due, 3 days after)

Fire clients who consistently pay late (yes, really)

Offer incentives for faster payment (discount, priority service)

If the constraint is inventory:

Move to just-in-time ordering

Negotiate better supplier terms (pay in 30, not 15)

Track inventory turnover rate and adjust buying patterns

Drop products with slow turnover

If the constraint is overhead:

Tie hiring to revenue thresholds (no new hires until revenue hits $X)

Move to variable costs where possible (contractors vs. employees)

Renegotiate fixed contracts annually

Build a decision matrix for new expenses (revenue impact required before approval)

If the constraint is tax timing:

Automate tax savings (30% of every deposit goes to separate account)

Work with accountant to estimate quarterly taxes accurately

Build tax liability into your cash flow forecast

Never touch tax savings account except for taxes

If the constraint is owner draws:

Set fixed monthly owner compensation (treat yourself like an employee)

Take distributions quarterly based on actual profit, not monthly based on feelings

Separate business cash from personal cash (different accounts)

Don't draw until you've reviewed your 13-week forecast

You've now elevated the constraint. It won't break the same way again.

Step 5: Find the Next Constraint

Once you fix one cash flow constraint, another appears. That's not failure. That's how constraints work.

Fix receivables, and suddenly inventory timing becomes the bottleneck. Fix inventory, and overhead becomes the issue.

The hierarchy usually follows this order:

Receivables (most common first constraint)

Inventory/capital lock-up

Overhead timing

Tax planning

Owner draw discipline

You don't need to fix them all at once. You need to fix them in order.

The Operating System Component: How You Handle Financial Stress

Here's the part most cash flow advice ignores: Some owners can't follow a forecast even when they have one.

Not because they're irresponsible. Because their operating system isn't designed for delayed gratification.

Your financial operating system includes:

How you handle scarcity (panic vs. strategic)

How you make decisions under pressure (reactive vs. calculated)

How you process risk (conservative vs. aggressive)

How you relate to money (security vs. tool)

If your operating system says "I need to feel secure before I act" but cash flow requires you to delay payments strategically, you're fighting yourself. You'll pay everything immediately even when it's not optimal.

If your operating system says "I trust my gut" but cash flow requires data-based decisions, you'll keep drawing based on feelings instead of forecasts.

This is where The O8 framework matters: Fix both or fix neither.

You can build perfect cash flow systems. If your operating system sabotages them, they won't work.

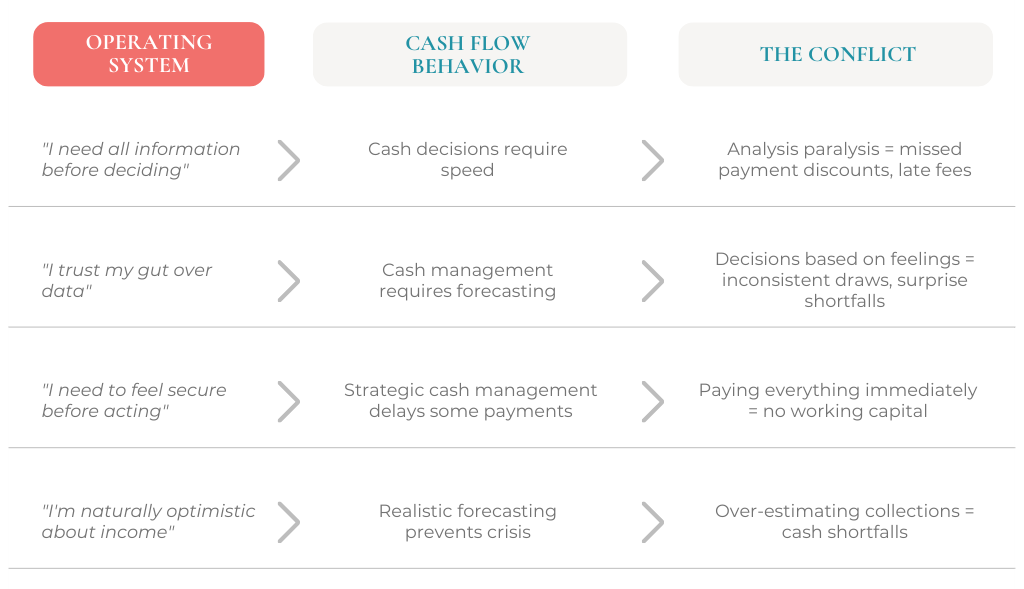

Examples of operating system conflicts:

The O8 approach: Build cash flow systems that work with your operating system, not against it.

If you need security, build bigger cash reserves. If you're gut-driven, create simple decision triggers based on account thresholds. If you need all the data, build dashboards that give it to you fast.

Don't fight how you're wired. Design operations that work with it.

When Cash Flow Is Actually a Revenue Problem

Sometimes cash flow problems aren't timing problems. They're math problems.

The breakeven test:

Your business has a breakeven point—the revenue level where income exactly covers expenses. Below it, you're losing money. Above it, you're profitable.

If your cash flow problems persist even after fixing timing, you're probably below breakeven.

How to know:

Take your fixed monthly costs (rent, payroll, software, insurance—everything that doesn't change with sales).

Divide by your gross margin percentage (revenue - direct costs / revenue).

That's your breakeven revenue.

Example:

Fixed costs: $35,000/month

Gross margin: 60%

Breakeven revenue: $35,000 / 0.60 = $58,333/month

If you're consistently bringing in $50,000/month, you're not having a cash flow problem. You're having a revenue problem.

The fix isn't cash management. The fix is pricing, sales, or cost structure.

Don't confuse the two. Timing problems and math problems require different solutions.

The Cash Flow Forecasting System That Actually Works

Here's the implementation. Week by week.

Week 1: Build Your Baseline

Pull last 3 months of bank statements

Categorize every transaction (collections, payroll, rent, vendors, taxes, owner draws)

Identify patterns (when money comes in, when it goes out)

Note any irregular expenses (annual subscriptions, quarterly taxes)

Week 2: Create Your 13-Week Forecast

List every invoice you expect to collect (with realistic collection dates, not invoice dates)

List every expense you know is coming (payroll, rent, subscriptions, vendor payments)

Include irregular expenses (taxes, insurance, annual renewals)

Calculate weekly cash balance projections

Week 3: Identify Your Constraint

Find your lowest projected cash balance week

Trace it back to the cause (receivables? overhead? owner draw?)

Name the constraint specifically

Week 4: Exploit and Elevate

Take immediate action to exploit (accelerate collections, delay non-critical payments)

Build the permanent fix (change terms, automate savings, adjust draw schedule)

Update your forecast with new assumptions

Week 5-13: Monitor and Adjust

Update your forecast every Monday morning (15 minutes)

Compare actual to projected (learn from variance)

Adjust actions based on what's actually happening

When you fix one constraint, identify the next

This becomes your operating rhythm. Monday morning, 15 minutes, update the forecast.

You can't manage what you don't measure. Now you're measuring.

Common Cash Flow Mistakes (And How to Avoid Them)

Mistake 1: Managing to account balance instead of forecast

Your account shows $30,000. Looks good. Doesn't mean you have $30,000 to spend. You have committed expenses coming.

Fix: Only make spending decisions after checking your 13-week forecast.

Mistake 2: Confusing profit with cash

Your P&L says you made money. Your bank account says otherwise. Profit is accrual. Cash is reality.

Fix: Track cash flow, not just profit.

Mistake 3: Not separating tax savings

You made $100,000 profit. You spent $100,000. Tax bill arrives. You owe $30,000. You don't have it.

Fix: Automate tax savings. 30% of every deposit into separate account. Don't touch it.

Mistake 4: Agreeing to payment terms without modeling impact

Client wants net-60. You say yes. You just gave them a $50,000 interest-free loan without realizing it.

Fix: Model payment terms before agreeing. Know the cash impact.

Mistake 5: Taking owner draws based on feelings, not forecasts

Account balance looks healthy. You take $20,000. Next week, payroll hits. You're short.

Fix: Fixed monthly draw based on forecast. Quarterly profit distributions if forecast supports it.

The Reality Check

Cash flow problems aren't about being bad with money. They're about timing gaps you didn't design for.

You can be profitable and broke. Both are true simultaneously.

The fix isn't hoping it gets better. The fix is identifying the constraint—where the timing breaks—and elevating it permanently.

The O8 framework: Operations + Operating System.

Build the systems. Understand how you're wired to handle financial pressure. Design one to work with the other.

Fix both or fix neither.

Your cash flow constraint is killing you right now. You don't need more revenue. You need better timing.

Build the forecast. Find the constraint. Fix it.

Or stay broke despite being profitable. That's a choice too.

Related Reading:

How to remove yourself from daily business operations (operational constraints)

The 6 bottlenecks every business hits (constraint hierarchy)

How to delegate as a business owner (decision-making constraints)

THE GETAWAY

Your final destination for ditching the overwhelm and stress of running a business.

Get The BRIEF

Smart plays - straight to your Inbox!